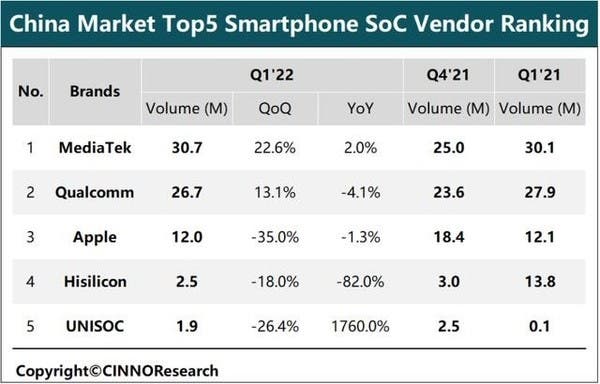

According to data from market research firm CINNO Research, in the first quarter of 2022, smartphone SoC shipments in mainland China were about 74.39 million units, down 14.4% from the same period last year and a slight increase of 0.7% from the fourth quarter of last year. In terms of brand market share for Chinese smartphones, in the first quarter of 2022, MediaTek ranks first in China’s smartphone SoC market with a share of 41.2%, an increase of about 7% year on year. Qualcomm accounts for about 35.9%, an increase of about 4% year-on-year, ranking second. The third to fifth places are Apple, HiSilicon and Unisoc.

Overall, the competition pattern of smartphone SoC brands in the Chinese mainland market remains the same. MediaTek and Qualcomm take the lead while Apple follows. Somehow, HiSilicon still has a place in the top 5. However, it is worth noting that the share of MediaTek’s quarterly shipments is expanding. Its shipment share in the first quarter exceeds 40%, hitting a record high for a single quarter since 2015.

In addition, the share of shipments of Apple and HiSilicon both decreased month-on-month and year-on-year. Among them, Apple’s quarter-on-quarter decline was the largest, because last quarter was Apple’s strong shipment period, so the month-on-month decline will be relatively large. Nevertheless, HiSilicon has the largest year-on-year decline. The inability to produce chips after being sanctioned by the United States has led to a sharp drop in shipments.

CINNO Research believes that due to the current downturn in the Chinese mobile phone market, the SoC market is also going downwards. However, MediaTek’s Dimensity series chips continue to impact the high-end market. With the implementation of the dual flagship strategy of mobile phone manufacturers and the blessing of TSMC’s high-yield foundry, it is estimated that the market share will maintain an upward trend in the future.

Top 5 chip makers for Chinese smartphones

1. MediaTek

MediaTek has been doing quite well in the chip market. It gets most of its revenues from the mid-range and entry-level markets. However, it has some pretty decent flagship processors like the Dimensity 1200 and its latest Dimensity 9000 SoC.

At the end of 2021, MediaTek’s revenue hits $17.6 billion, a new record for the Taiwanese chipmaker. Relative to the previous year, this figure represents a 53% increase. According to Counterpoint Technology Market Research, MediaTek’s sharp revenue growth is due to the rapid development of 5G and Wi-Fi 6 technologies. In addition, investments in energy-saving solutions are bearing fruit.

In the current quarter, MediaTek’s revenue is projected to rise by 2-10% compared to the last quarter of 2021, amounting to $4.7-$5.1 billion. This should be facilitated by the launch of the flagship mobile processor Dimensity 9000. Smartphones running it are in preparation by such major developers as Oppo, Vivo, Xiaomi and others.

Analysts believe that according to the results of the current quarter, MediaTek will become a leader in the smartphone processor market with a share of 39% in unit terms. According to Counterpoint Technology Market Research forecasts, in 2022 the share of 5G devices in the total mass of smartphones sold will reach 54%, or approximately 800 million units. MediaTek will continue to actively invest in related technologies.

2. Qualcomm

No doubt, Qualcomm is the “king” when it comes to flagship processors for Android smartphones. However, it is Qualcomm’s 5G baseband business that is making waves

Sravan Kundojjala, Director of Handset Component Technologies service at Strategy Analytics, said, “Qualcomm increased its 5G baseband unit share to 70 per cent in Q1 2021, driven by Apple iPhone 12 design-wins and Android 5G momentum. Qualcomm’s new 5 nm-based Snapdragon 888 5G applications processor off to a strong start and featured in popular flagship devices. Qualcomm benefited from HiSilicon’s retrenchment due to trade sanctions and gained 5G market share. For the first time in four years, HiSilicon dropped out of the top-five baseband revenue share rankings. Strategy Analytics believes that Qualcomm is well-situated to grow its 5G baseband shipments with the help of its multi-tier portfolio.”

Christopher Taylor, Director of the Strategy Analytics RF & Wireless Components service, added, “MediaTek established itself as the strong number two to Qualcomm in the 5G baseband market in Q1 2021 with its Dimensity-branded 5G chips. MediaTek’s baseband revenue grew 162 per cent year-on-year in Q1 2021, driven by 5G and 4G share gains. Strategy Analytics believes that MediaTek’s 5G momentum will continue through 2021, driven by expansion beyond China.”

3. Apple

Apple sells its devices in China so we closely consider its chip as running on Chinese smartphones. The Bionic processors are far ahead of their Android counterparts. These processors boost the performance of Apple’s smartphones. Its latest Bionic A15 processor excels in overall performance. Apple Bionic A15 chip adopts a design architecture of 2 large cores + 4 small cores in the CPU part. This improves performance by 20% and energy efficiency by 30% relative to the A14 chip. On the GPU side, the A15 chip adopts a 5-core architecture, which increases the number of GPU cores.

Looking at the percentage improvement, the A15 has a very significant improvement. This further opens up the performance gap with the Android camp. However, due to the poor heat dissipation performance of the iPhone, it is often difficult to achieve the full performance of the A-series processors.

Apple will also have more influence in the smartphone market due to the absence of Huawei. However, Apple will not want to take other Chinese manufacturers for granted. IDC released a report on the market share of smartphones in the price segment above $600 in the first half of 2020. Among mobile phones exceeding $600, Huawei ranks first with 44.1%, and Apple ranks second with 44%. In the first quarter of this year, IDC released data on China’s market share in the price range above $550. Apple ranks first with a market share of 56.9%. Huawei still ranks second but its share dropped to 23.6%.

4. Huawei HiSilicon still makes the list

In addition, the sales of Apple’s A-series chips are still increasing, ranking third. However, the rapid increase in the past one or two months is now slowing down. Huawei HiSilicon and UNISOC rank fourth and fifth with sales of 1.1 million and 800,000 units respectively. The market share of HiSilicon chips was the same month-on-month, but the year-on-year decline was still huge. CINNO Research analysts said: HiSilicon’s inventory is still unable to predict when it will bottom out, and it still adopts a series of inventory control methods.

CINNO Research predicts that MediaTek will be the largest processor manufacturer in China’s smartphone SoC market in 2021. The market share is expected to increase to 36%, and Qualcomm is expected to increase to 35%. In China’s 5G smartphone market, Qualcomm is the largest processor manufacturer. The market share is expected to increase to 37%, and the MediaTek market share is expected to increase to 34%.

In the coming months, there will be significant differences in the outlook of the chip market. The new Snapdragon 8 Gen1 will be a driving force for Qualcomm. However, unlike previous years, MediaTek has the Dimensity 9000 which almost matches the performance of the Snapdragon 8 Gen1. The first smartphones with Dimensity 9000 will be official next month.

5. UNISOC

UNISOC Tiger chips are mostly entry-level and at best mid-range chips that appear mainly on Chinese smartphones. Considering that there are not many chipmakers globally, UNISOC has a spot on the top five list.